How to actually save for a house

It’s just a matter of having a plan!

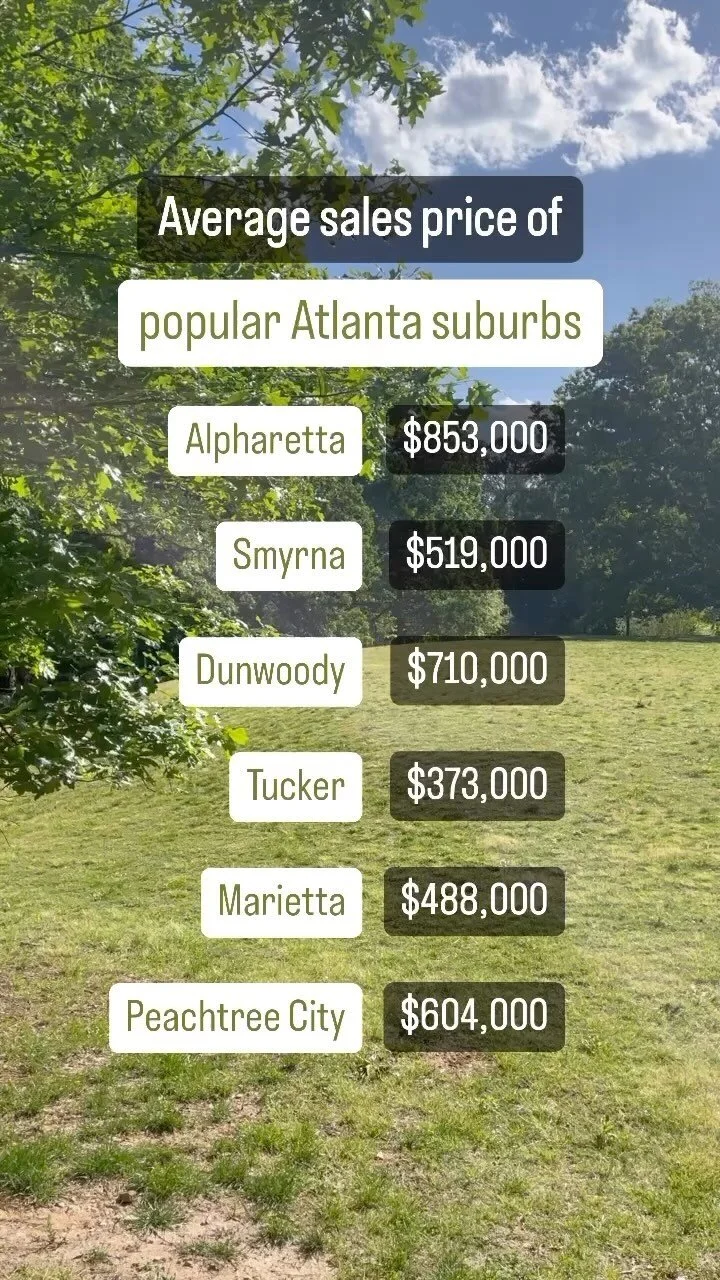

As a real estate agent, I've witnessed the struggles many face while trying to save for their dream home here in the Atlanta area. But fear not! I'm here to provide you with a step-by-step guide to kickstart your journey to homeownership. Let's dive right in! 🌟

“I’m here to provide you with a step-by-step guide to kickstart your journey to homeownership.”

𝟎𝟏) 𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐘𝐨𝐮𝐫 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐒𝐭𝐚𝐧𝐝𝐩𝐨𝐢𝐧𝐭

To begin your quest, let's get a clear understanding of your finances. Utilize budgeting apps like Mint or 'You Need a Budget' to track your income and expenses. Determine what you can comfortably set aside each month for your housing expenses. Knowing your financial standing is crucial for a successful home-buying journey.

𝟎𝟐) 𝐒𝐚𝐯𝐞 𝐟𝐨𝐫 𝐚 𝐃𝐨𝐰𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭

Now that you have your budget sorted, it's time to start building your 'house fund.' Open a high-yield savings account and set up automatic monthly transfers. As of July 2023, some high-yield savings accounts offer nearly 5% interest rates, which can help your savings grow faster. Remember, rates may vary, so it's essential to shop around for the best option.

𝟎𝟑) 𝐏𝐫𝐚𝐜𝐭𝐢𝐜𝐞 𝐆𝐨𝐨𝐝 𝐂𝐫𝐞𝐝𝐢𝐭 𝐇𝐲𝐠𝐢𝐞𝐧𝐞

A healthy credit score is vital when it comes to securing a favorable mortgage. Aim to maintain a credit utilization ratio of less than 30% of your credit limit, pay bills on time, and work towards reducing or consolidating high-interest debt. These practices can boost your credit score, leading to better mortgage rates and more attractive loan options.

𝟎𝟒) 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐌𝐨𝐫𝐭𝐠𝐚𝐠𝐞 𝐏𝐫𝐨𝐠𝐫𝐚𝐦𝐬

Don't let the down payment be a roadblock to your Atlanta homeownership dreams. Explore loan programs that offer lower down payment options. Many federal, state, and local programs are designed to help first-time homebuyers with favorable mortgage terms. Be sure to investigate all the available options and find the one that best suits your needs.

💡 𝐓𝐈𝐏: I'm here to support you every step of the way, including getting you connected with a trusted mortgage lender. Send me a message, and I'll be glad to assist!

Ready to take the next step? Reach out here, and I'll send you the link to my comprehensive buyer guide. This guide is packed with in-depth insights and strategies to make your Atlanta home buying journey smoother than ever.

𝐒𝐚𝐯𝐞 𝐭𝐡𝐢𝐬 𝐩𝐨𝐬𝐭 𝐟𝐨𝐫 𝐟𝐮𝐭𝐮𝐫𝐞 𝐫𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞, and 𝐟𝐨𝐥𝐥𝐨𝐰 𝐦𝐞 𝐟𝐨𝐫 𝐦𝐨𝐫𝐞 𝐞𝐱𝐜𝐢𝐭𝐢𝐧𝐠 𝐜𝐨𝐧𝐭𝐞𝐧𝐭! 🏠

Don't forget to save this post for future reference and share it with your friends who might also be dreaming of becoming proud homeowners. Together, we can turn those dreams into a reality! 🌈