The ultimate guide to your first investment property in Atlanta

You've probably heard it said, 'Real estate is the safest investment in the world.' But when it comes to dipping your toes into the investment property pool for the first time, it can feel like anything but safe. My husband and I became “accidental” landlords in 2010; when we wanted to move but were having a hard time selling our home in Lawrenceville, GA. So, we decided to rent it out, instead. We learned a TON along the way, and now own 4 rental properties total. While it’s not always easy, it’s 100%, completely worth it.

“Want to dive deeper? Download my free resource here: Real Estate Investing 101.”

New construction can be a great option for a low maintenance investment property in Atlanta.

Here are a few things I’ve learned along the way:

1) Start With the End in Mind: It's important to clarify what you want out of this investment. Are you looking for monthly cash flow, or a long-term appreciation plan? Or both? Different types of Atlanta area properties will fit different goals, so being clear on your 'why' is crucial.

2) Understand Your Budget: This goes beyond knowing how much you can afford to spend on an investment property. You also need to consider the ongoing costs of owning and managing it, including taxes, maintenance, insurance, and potential vacancies. I recommend running your numbers on Deal Check and get comfortable with all the variables.

3) Choose Your Property Type: Whether it's a single-family home, a duplex, or a commercial property, your choice will heavily depend on your budget and your investment goals. Research the average costs, rental rates, and Atlanta neighborhood market trends for each type in your desired part of town.

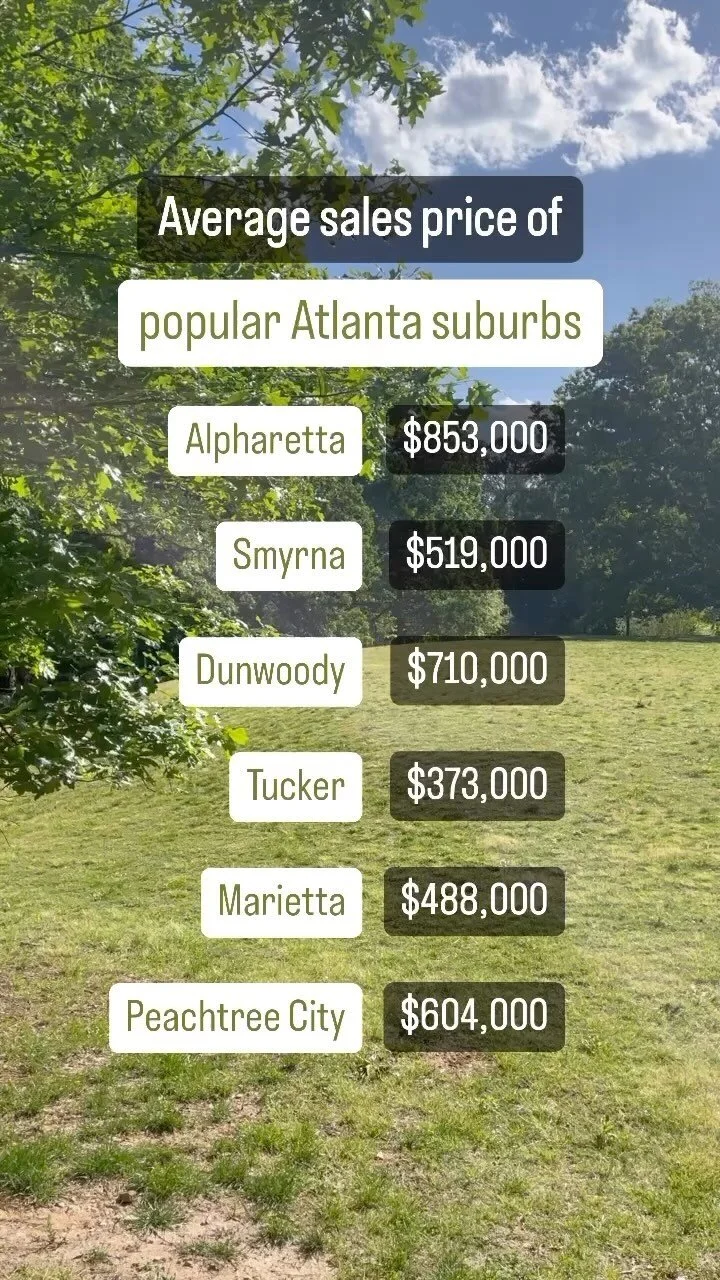

4) Location, Location, Location: Remember, you're not just investing in a property, but also in a location. Look for suburbs in Atlanta with a strong rental market, promising future developments, and amenities that will attract tenants. Location is important when you are making ANY kind of real estate decision!

5) Build Your Team: Just like you wouldn't whip up a complex dish without the right kitchen tools, you shouldn't venture into real estate investment without the right team. This includes a trustworthy real estate agent, a reliable property manager, a knowledgeable lender, and an experienced lawyer. I know people, so reach out and ask anytime!

There you have it—your recipe for success in your first real estate investment venture.

Want to dive deeper? Download my free resource here: Real Estate Investing 101.